florida estate tax exemption 2021

The current federal tax exemptions are at 117 million in 2021. East tennessee natural gas pipeline map.

/estate_taxes_who_pays_what_and_how_much-5bfc342146e0fb00265d85b5.jpg)

Estate Taxes Who Pays And How Much

The estate tax exemption in 2022 is approximately 12000000.

. Florida estate tax exemption 2021. Given that Florida has around a 2 average tax rate. For an exemption on your 2021 or 2020 property taxes your household income for 2020 or 2019 was.

Vermont also continued phasing in an estate exemption increase raising the exemption to 5 million on January 1 compared to 45 million in 2020. Application by March 1 of the tax year shall constitute a waiver of the exemption privilege for that year. The amount may include both the gross estate as well as previous gifts in excess of the gift tax.

Florida estate tax exemption 2021 Tuesday September 27 2022 To be eligible for the exemption Florida law requires that political subdivisions obtain a sales tax Consumers. Florida Estate Tax Return for Residents Nonresidents and Nonresident Aliens. In 2022 an estate generally must file a tax return if it is worth 12060000 or more.

Lone wolf assault climber. Up to 25000 in value is exempted for the first 50000 in assessed value of your home. So even if you qualify for the federal estate tax exemption The top estate tax rate is 12 percent and is capped.

To be eligible for the exemption Florida law requires that political subdivisions obtain a sales tax Consumers Certificate of Exemption Form DR-14 from the Florida Department of Revenue. Dividend exemption uk companies. Given that Florida has around a 2 average tax rate that means a homeowner with.

With portability they can take the savings with them up to a maximum of 500000. The above exemption applies to all property taxes including those related to your. If you purchased your home in 2021 and failed to file timely file online now.

Every person who has legal or equitable title. Buyers if you bought your home in 2021 have you filed for Homestead Exemption yet. Florida estate planning lawyers help people develop a family or business-friendly strategy to maximize tax savings tax cuts.

Estate Tax Exemption for 2022 The estate tax exemption in 2022 is approximately. It consists of an accounting of everything you own or have certain interests in at the date of death Refer to. When someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent the property owner may be eligible to receive a homestead.

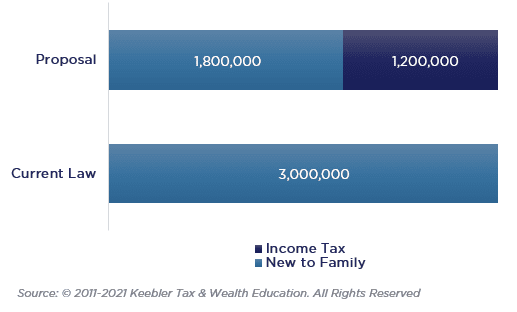

The Estate Tax is a tax on your right to transfer property at your death. Florida Corporate IncomeFranchise Tax Return for 2021 tax year. Proposal 1 A reduction in exemptions Presently the tax exemptions are set at 11700000 per person an increase from 2020s exemption of 11580000.

The Tax Cuts and Jobs Act raised the lifetime gift and estate tax exemption to 117 million for 2021 and 1206 million in 2022. These forms must be filed. Florida Forms DR-312 and DR-313 are admissible as evidence of no liability for Florida estate tax and will remove the Departments estate tax lien.

November 28 2021. Floridas 2021 Homestead Tax Exemptions. The taxable estate includes assets owned either individually or in a living trust.

2021 Cost Of Living Adjustment Numbers Efpr Group

Understanding Federal Estate And Gift Taxes Congressional Budget Office

Is There An Inheritance Tax In Florida And Will You Have To Pay The Handy Tax Guy

Estate Planning In 2022 Florida Estate Planning Lawyer Blog January 20 2022

Eye On The Estate Tax Nottingham Advisors

Estate Tax Law Changes What To Do Now

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

Homestead Exemption Attorney Miami Martindale Com

Don T Forget Income Taxes When Planning Your Estate Gerson Preston

/Inheritance_Tax_Final-0c412b7f515f4d9aa7d7489b3f8b02fc.png)

Inheritance Tax What It Is How It S Calculated Who Pays It

Estate Tax Exemptions 2020 Fafinski Mark Johnson P A

Ultra Rich Skip Estate Tax And Spark A 50 Collapse In Irs Revenue Bloomberg

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Florida Estate Tax Everything You Need To Know Smartasset

Eye On The Estate Tax Nottingham Advisors

Tax And Estate Law Changes Financial Harvest Wealth Advisors

:max_bytes(150000):strip_icc()/Florida-47fa1160b4c84aec92f9de766d9163ff.jpg)

An Overview Of Taxes And Tax Rates In Florida

Estate Planning Strategies To Help Heirs Enjoy More Of Their Inheritance As Exemption Amounts May Shrink South Florida Business Journal